Uninsured motorist This insurance coverage pays for problems if you or an additional covered individual is injured in a car collision triggered by a driver that does not have liability insurance policy. perks. In some states, it may additionally pay for residential property damage.

Underinsured motorist insurance coverage is subject to a policy restricts chosen by the insured. Rental repayment This coverage pays for service costs if your vehicle is disabled due to a protected loss - cheapest car.

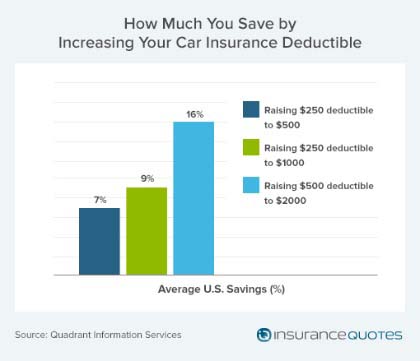

You have to pay your car insurance coverage deductible for the claim to be total. You don't get your insurance claim payment without paying your insurance deductible (cheaper car insurance). If you are unable to pay your deductible at the time of your crash, it is best to wait. Do not send in your insurance claim to your insurance business if you can not pay your deductible.

There are two other kinds of insurance coverage that use deductibles:- PIP covers medical costs for you as well as your travelers.- This type of protection safeguards you when you're struck by a motorist who does not have insurance.

There are some cars and truck insurance coverage companies that do not call for in advance payment. Typically, it functions either methods: Your insurance company deducts the insurance deductible from your case payout. Let's claim your insurance claim is approved for $2,500 as well as your insurance deductible is $500. laws. Your insurance provider creates you a check for $2,000.

You after that pay them month-to-month till your deductible is paid off. It aids if you have a long-lasting organization relationship with your auto mechanic and can reveal a straightforward need.

The Lyft Is Charging Me A $2,500 Deductible. I Don't Have It! - Long ... Statements

If you're in a circumstance where you can't pay your deductible there some points you can do. You require to discover a method to pay your insurance deductible.

- A couple of states use the alternative of picking a $0 deductible on thorough insurance policy. - For any kind of glass damages that can be repaired rather of changed, you might not need to pay a deductible - money.

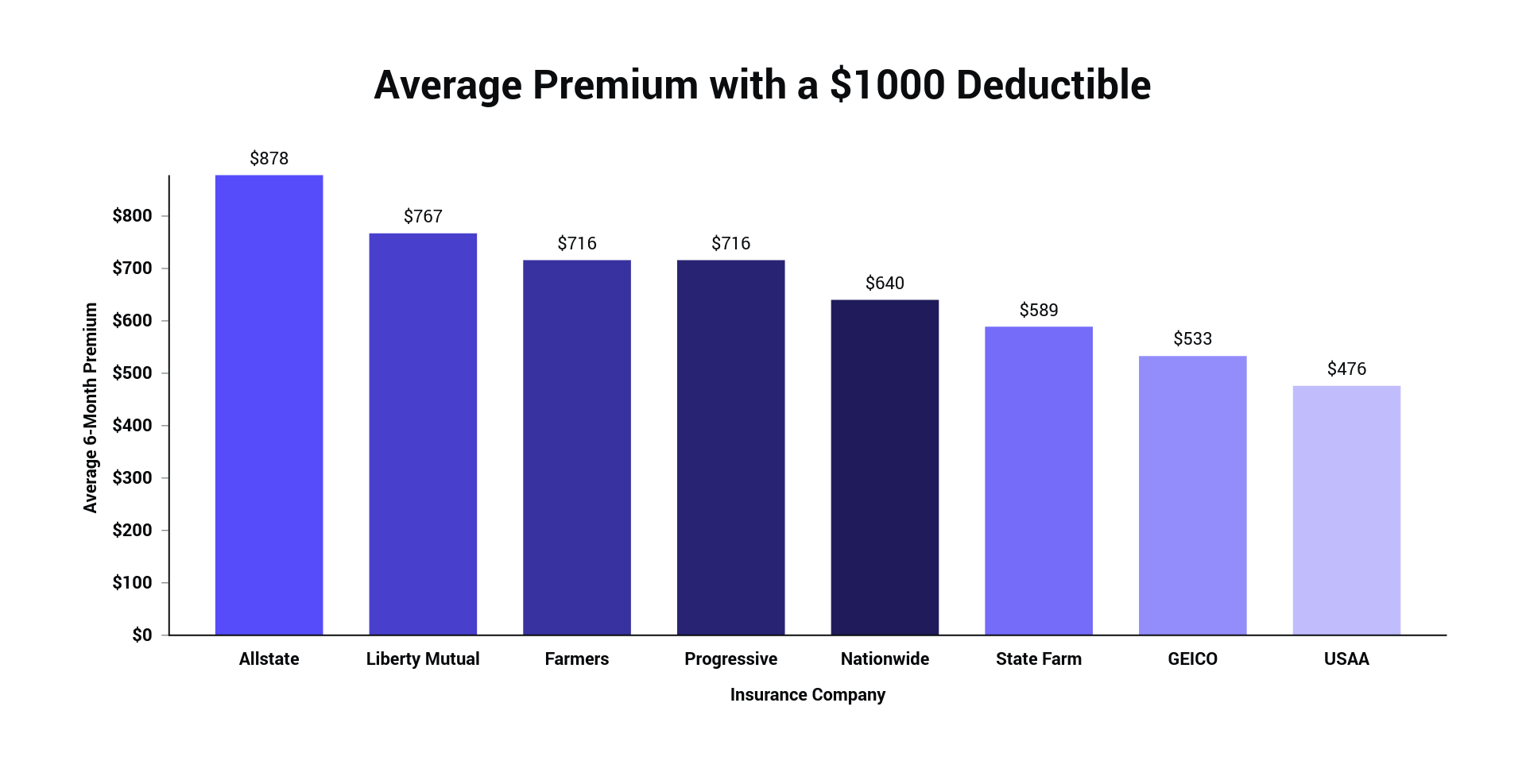

Provided below are other points you can do to reduce your insurance policy prices. 1. Search Costs vary from company to company, so it pays to search. Access the very least three estimate. You can call business directly or gain access to info on the net. Your state insurance coverage department might additionally supply contrasts of costs charged by significant insurance firms.

It's vital to choose a company that is monetarily steady. Obtain quotes from various kinds of insurance policy firms (cheap car). These agencies have the same name as the insurance coverage company.

Others do not use representatives. They sell directly to customers over the phone or using the Net. Do not shop by price alone. Ask friends and also relatives for their recommendations. Contact your state insurance policy department to discover whether they supply information on customer complaints by firm. Select an agent or business agent that puts in the time to address your concerns.

Prior to you purchase an automobile, compare insurance policy expenses Prior to you purchase a new or previously owned car, check into insurance policy prices. Automobile insurance policy premiums are based in part on the auto's rate, the price to fix it, its general safety and security record as well as the likelihood of burglary.

What Happens If You Can't Pay Your Car Insurance Deductible? Things To Know Before You Buy

Evaluation your protection at renewal time to make certain your insurance policy demands have not transformed. 5. Buy your property owners and also auto insurance coverage from the same insurance firm Lots of insurers will certainly offer you a break if you purchase two or even more types of insurance. You may also obtain a decrease if you have greater than one lorry guaranteed with the exact same business.

Ask regarding group insurance Some firms supply reductions to chauffeurs that obtain insurance through a group strategy from their companies, through professional, organization and alumni groups or from other organizations - cheaper auto insurance. Ask your employer and inquire with teams or clubs you are a participant of to see if this is feasible.

/Understanding-What-is-a-Deductible-in-Insurance-Women-Explaining-58900c523df78caebc6ea56b.jpg) affordable car insurance insure insurance prices

affordable car insurance insure insurance prices

Choose various other price cuts Business use price cuts to policyholders that have not had any type of accidents or relocating violations for a variety of years. You might likewise obtain a discount if you take a protective driving course. If there is a young motorist on the policy that is an excellent pupil, has actually taken a motorists education and learning course or is away at college without an Visit this website automobile, you may also get approved for a lower price.

The vital to cost savings is not the discounts, however the last rate (insured car). A firm that uses few price cuts might still have a reduced overall cost. Federal Person Details Center National Consumers Organization Cooperative State Research, Education, as well as Extension Service, USDA.

You have broad accident coverage, If you have broad crash protection you might be able to have your deductible waived: If you are much less than half in charge of the accident, If you are much more than one-half liable, the deductible stands and you need to pay it (car). If the other individual in the crash is completely liable, that individual's insurance will commonly pay all repair work charges, including what you would certainly have paid for the deductible2.

cheapest auto insurance low cost vehicle insurance affordable

cheapest auto insurance low cost vehicle insurance affordable

cheap cheapest car perks auto insurance

cheap cheapest car perks auto insurance

affordable car insurance liability car insurance

affordable car insurance liability car insurance

risks cars car insured insurance company

risks cars car insured insurance company

CDWs do not pay if the person that strike you includes you in a hit-and-run accident. 3 - liability. The other driver is without insurance, In some states you can purchase a without insurance vehicle driver protection-damage policy (UMPD), which covers you up to a defined quantity if the other chauffeur associated with the mishap does not have automobile insurance policy.

Getting The Car Insurance Deductibles: How Do They Work? - The Motley ... To Work

You file a claim with your insurance provider to cover the damages to your lorry. low cost auto. When you submit a car insurance coverage case, you require to pay a deductible before your insurance provider covers the continuing to be costs (cheaper). Allow's say your lorry has $5,000 worth of damages and also you have a $1,000 deductible.

Once you have actually paid the deductible, the car insurer will take control of. Check out the terms of your insurance plan to make certain you understand exactly how your insurance deductible jobs. cheapest car. You May Not Have to Pay Your Insurance Deductible in Certain Situations There are particular situations where you do not need to pay an insurance deductible, including: A Guaranteed Vehicle Driver Strikes You and Is At Fault If the other vehicle driver is located officially to blame for the mishap, then the various other motorist's insurance provider will pay for your repairs and you will certainly not have to pay your insurance deductible.